wells fargo class action lawsuit 2018

Wells Fargo allegedly used its own software to calculate a borrowers eligibility for HAMP rather than use the tool developed by Fannie Mae for this exact purpose. The Complaint can be read HERE.

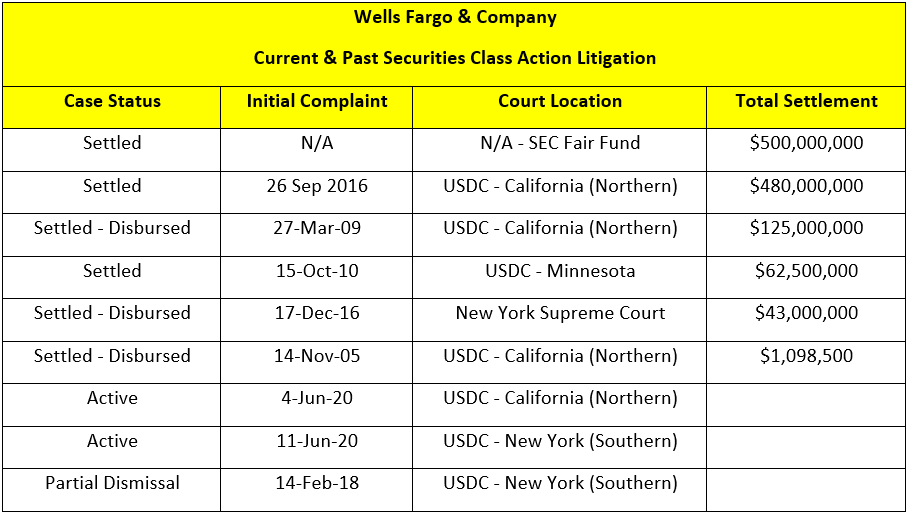

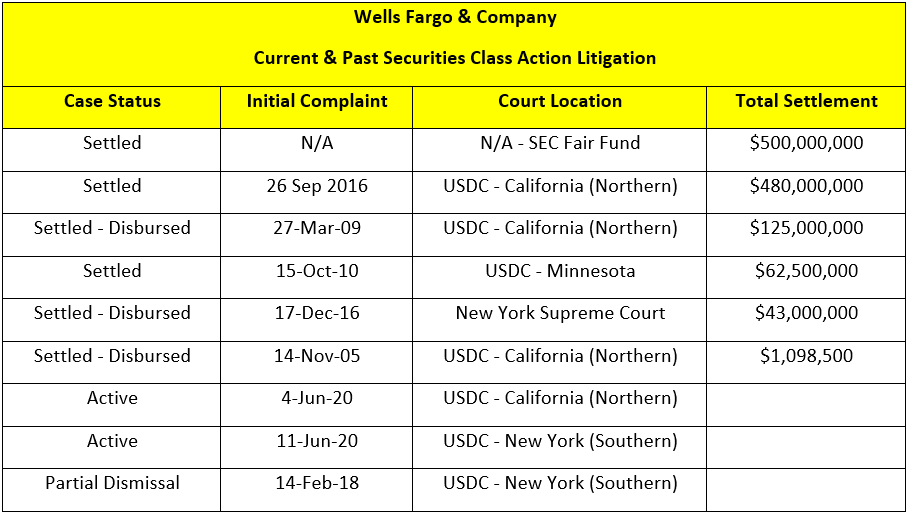

Wells Fargo Settles 480m Class Action Brought By Investors Philadelphia Business Journal

WFC of a class action securities lawsuit.

. 18 2022 PRNewswire -- Levi Korsinsky LLP notifies investors in Wells Fargo Company Wells Fargo or the Company NYSE. Allocation Plan payments are being issued and mailed directly by Wells Fargo on a rolling basis. 120 IBM 401k Plan Class Action Lawsuit.

Wells Fargo has settled a class action lawsuit involving its fraudulent practices of lowering mortgage interest rates. Some of the claims include high-pressure sales tactics forged signatures and unauthorized account opening. A Wells Fargo class action lawsuit was filed in June 2016 in response to the banks actions in the financial industry.

In November 2018 Wells Fargo revised its estimate announcing that the miscalculation actually affected 870 homes that were going through foreclosure between March 15 2010 and April 30 2018. While it has been reported that some lenders have refused to approve Black applicants the class action lawsuit against Wells Fargo has been filed in the Northern District of California. In October 2017 the case was consolidated with other cases filed nationwide in an MDL Multi-District Litigation and.

Joshua Bloomfield prosecutes complex class action lawsuits with particular experience in data breachprivacy cases and antitrust matters. Those with a Wells Fargo loan may be able to benefit from the settlement if between 2010 and. Its settlement with customers.

Those employees many of whom were unionized suffered the. They claim that Wells Fargo made a math error causing some costs to be miscalculated resulting in improper loan denials. REUTERSMike BlakeFile Photo.

Filed a class action lawsuit against Wells Fargo Home Mortgage for wrongfully denying mortgage modifications to homeowners in need. The settlement will benefit certain mortgage loan borrowers. A California federal judge granted final approval for a 142 million class action settlement over claims that Wells Fargo opened fake bank accounts despite many arguments that the settlement is insufficient.

Wells Fargo home loan customers who lost their homes may be able to benefit from an 185 million settlement that if approved by the court will end a class action lawsuit alleging bank errors led to mortgage holders losing their homes to foreclosure. Wells Fargo Mortgage Modification Lawsuit. April 23 2020 A class action lawsuit has been filed against Wells Fargo by small businesses who claim that the bank prioritized Paycheck Protection Program PPP loans to those businesses who were seeking larger loan amounts as those applications would generate larger loan origination fees for the banks.

The government said this. Wells Fargo failed to disclose the interest rate during the buydown period and instead applied a higher interest rate to the loans. In December 2018 a number of plaintiffs filed this class action complaint alleging that they lost their houses to foreclosure after being wrongfully denied loan modifications.

A class-action lawsuit against Wells Fargo is currently underway but the allegations are complex and have been the subject of many recent news reports. Between September and October 2018 Wells Fargo sent letters to approximately 870 customers who had applied for a mortgage modification. In August 2018 Wells Fargo admitted that a software error caused it to deny hundreds of borrowers who actually qualified for and were entitled to a loan modification under HAMP.

In addition to paying out a portion of the claims Wells Fargo will also cover legal costs which total 365 million. Wells Fargo has agreed to pay a 209 billion fine for issuing mortgage loans it knew contained incorrect income information the Justice Department announced Wednesday. LOS ANGELES Aug.

Wells Fargo will pay 480 million to put to rest claims that the bank misled shareholders about its fake-accounts scandal. District Judge Vince Chhabria stated that he would approve the 142 million settlement that had been reached between. 3 hours agoNEW YORK Aug.

17 2022 GLOBE NEWSWIRE -- Glancy Prongay Murray LLP GPM reminds investors of the upcoming August 29 2022 deadline to file a lead plaintiff motion in the class action filed on behalf of investors who purchased or otherwise acquired Wells Fargo Company Wells Fargo or the Company NYSE. Welcome to the Informational Website for the Wells Fargo CPI Class Action Settlement. According to the complaint the banks executives violated consumer rights by making misleading statements and failing to disclose material facts to increase sales.

In addition a recent investigation by the Los Angeles Times reveals that Wells. Reuters - Wells Fargo Co said on Friday it will pay 480 million to resolve a securities fraud lawsuit related to. Filed a class action lawsuit against Wells Fargo alleging the bank victimized its customers by charging them for unwanted auto insurance that they did not need.

A class-action securities fraud lawsuit brought by investors alleged that. On July 31 2017 Keller Rohrback LLP. 121 Wells Fargo Buydown Agreement Class Action Lawsuit.

WFC common stock between February. 17 2020 you are eligible for a potential award from the Creative Ceilings Settles Wage Statement Class Action Lawsuit. Under the Settlement Defendants are distributing at least 3935 million to Class Members pursuant to an Allocation Plan and Distribution Plan.

Troy Harlow Has Always Made Sure To Pay His Mortgage On Time Wells Fargo Had Other Plans For Him

Wells Fargo Identity Theft Protection Coverage 2022 Plans

Wells Fargo Wins Dismissal Of Shareholder Lawsuit Over Commercial Lending Reuters

Wells Fargo Class Action Lawsuit And Latest News Top Class Actions

Wells Fargo Must Face Shareholder Lawsuit Alleging Compliance Failures

Wells Fargo Mortgage Fee Class Action Settlement Top Class Actions

Wells Fargo Pays 7 8 Million In Discrimination Settlement Law Office Of Christopher Q Davis

Wells Fargo Agrees To 3 9m Settlement With For Wage Violations

Wells Fargo Forced To Pay 3 Billion For The Bank S Fake Account Scandal

Wells Fargo Mostly Defeats Two Lawsuits Over Mortgage Losses Reuters

Wells Fargo Bankruptcy Credit Reporting 3m Class Action Settlement Top Class Actions

Wells Fargo Shareholder Sues Over Reports Of Sham Diversity Policy Reuters

Investors Closer To 500 Million Payout From Wells Fargo Settlement

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement

Wells Fargo Class Action Lawsuit And Latest News Top Class Actions

Wells Fargo Paying 3 Billion To Settle U S Case Over Illegal Sales Practices Npr

Wells Fargo Pays 12m For Wrongly Denying Mortgage Modifications Housingwire

Chicago Case Ruling Could Impact Litigation Strategy In Philadelphia S Wells Fargo Lawsuit Philadelphia Business Journal

Wells Fargo To Pay 3 Billion To Doj Sec To Resolve Criminal Civil Charges Tied To Fake Accounts Scandal Cfcs Association Of Certified Financial Crime Specialists